We will have to pay for convenience starting this October.

While most Filipinos are still coping with the financial crisis caused by the COVID-19 pandemic that started in Wuhan, China, most Philippine banks and e-wallets GCash and PayMaya will start charging online bank transfer fees starting on October 1, 2020.

When these companies announced this news, many netizens expressed dismay as most people have been relying on these platforms for digital transactions, now that ‘cashless’ payments are highly encouraged.

While banks have been charging bank transfer fees pre-COVID times, this is the first time GCash and PayMaya will be charging fees for select digital transactions.

GCash

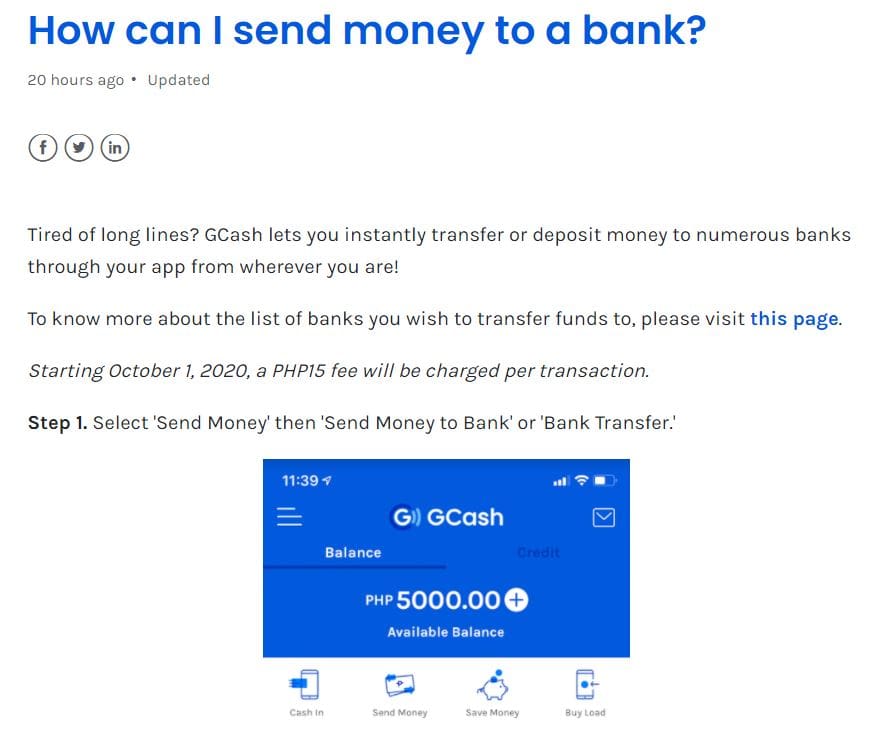

As of this writing, GCash has not yet disclosed the corresponding fees of online bank transfers. But users can now see the note on the app that says “Starting October 1, 2020, a PHP15 fee will be charged per transaction.“

- GCash Send to Bank (Bank Transfer): ₱15 per transaction

- Bank cash-in: None for partnered banks

- GCash to GCash: None

PayMaya

Here’s the updated list of charges and fees on PayMaya transactions starting on October 1.

SEND MONEY

| TRANSACTION | CHARGES AND FEES |

| Send Money PayMaya to PayMaya | Free |

| Send Money PayMaya to Smart Money (v.v) | 1.5% (Sender pays) |

| Bank transfer via the PayMaya app | Php 10.00* *Effective October 1, 2020 |

| Send to bank account via ATM ( IBFT via ATM) | Php 15.00* *Effective August 1, 2020 |

ADD MONEY

| TRANSACTION | CHARGES AND FEES |

| Add Money via over the Counter (OTC) Channels(Add Money Channel is not mentioned below will remain free of charge until further notice.)Convenience Stores7- Eleven (Convenience fee will be paid upon add money)Ministop (Waived fees until further notice)Self-service KiosksTouchPayeTapPay & Go Mall / Supermarket / Department StoresRobinsons Department Store Business CentersSM Store Business CentersGaisano CapitalRemittanceTambuntingRD PawnshopPalawan ExpressPera HubOther PartnersLBC ExpressECPayBayad CenterPos!bleDigipayiBayadSmart Stores | 1%* *Effective October 1, 2020. Fee shall only apply once you have exceeded Php 10,000 Add Money threshold within the month. |

| Add Money via Smart Padala Centers | A service fee worth Php15.00 will be changed for Add Money transactions up to Php1,000.00.Additional Php7.50 will be charged for every additional amount up to Php500.00. |

| Add Money via Bank – BDO Over-the-Counter | Free until further notice |

| Add Money via Bank Account | Free until further notice |

| Add Money via Instapay / PESONet | Fees vary depending on sending bank / financial institution |

ATM WITHDRAWAL AND BALANCE INQUIRY

| TRANSACTION | CHARGES AND FEES |

| ATM Witrawal Bancnet | Php 15.00* *Additional fees may apply depending on the bank ATM |

| ATM Witrawal Landbank | Php 5.00 |

| ATM Witrawal International | USD 2.00 – USD 5.00* *Additional fees may apply depending on the bank ATM |

| ATM Balance Inquiry | Php 2.50 |

BILLS PAYMENT

| TRANSACTION | CHARGES AND FEES |

| Bills Payment | Php 0.00 – Php 20.00* *Varies per biller. Exact biller fee is shown and applied during transaction confirmation |

MAINTAINING BALANCE

| TRANSACTION | CHARGES AND FEES |

| Maintaining Balance | No Fees |

PH BANKS

LIST OF BANKS TO CHARGE FEES ON OCTOBER 1

These banks will now charge for online transactions made through InstaPay, PESONet, etc.

- BDO Unibank, Inc.

- Metropolitan Bank and Trust Company

- Bank of the Philippine Islands

- Rizal Commercial Banking Corporation

- China Banking Corporation

- Bank of Commerce

- Robinsons Bank Corporation

- Philippine Savings Bank

- PayMaya Philippines, Inc.

- G-Xchange, Inc. (GXI)

- China Bank Savings, Inc.

- Philippine Bank of Communications (extending its P1.00 fee due to system constraints)

- Equicom Savings Bank, Inc.

LIST OF BANKS WAIVING FEES UNTIL DECEMBER 31

Below are the banks that extended the waived fees until December 2020.

- Union Bank of the Philippines

- Asia United Bank Corporation

- Land Bank of the Philippines

- Development Bank of the Philippines

- Security Bank Corporation

- Sterling Bank of Asia, Inc.

- Standard Chartered Bank

- East West Banking Corporation

- United Coconut Planters Bank

- Maybank Philippines, Inc.

- Hongkong and Shanghai Banking Corporation (waived for retail; for corporate – reduced from P150.00 to P50.00 from July 1, 2020)

Until further notice:

- Philippine National bank

- MUFG Bank, Ltd.

- CTBC Bank (Philippines) Corporation

- Bank of China Limited – Manila Branch

Can you help me sign this petition?

Because banks and fintech companies will charge online transactions starting Oct 1. I think it won’t do well for us right now, right?

Petition sa Change. org na continue to waive interbank transfers online kasi may bayad na starting Oct 1 ang online transfer kahit sa GCash:

http://chng.it/ndgdfbd9W5