With the rise of digitalization, even banks have gone online. And now, there is a new trusted digital bank called OwnBank.

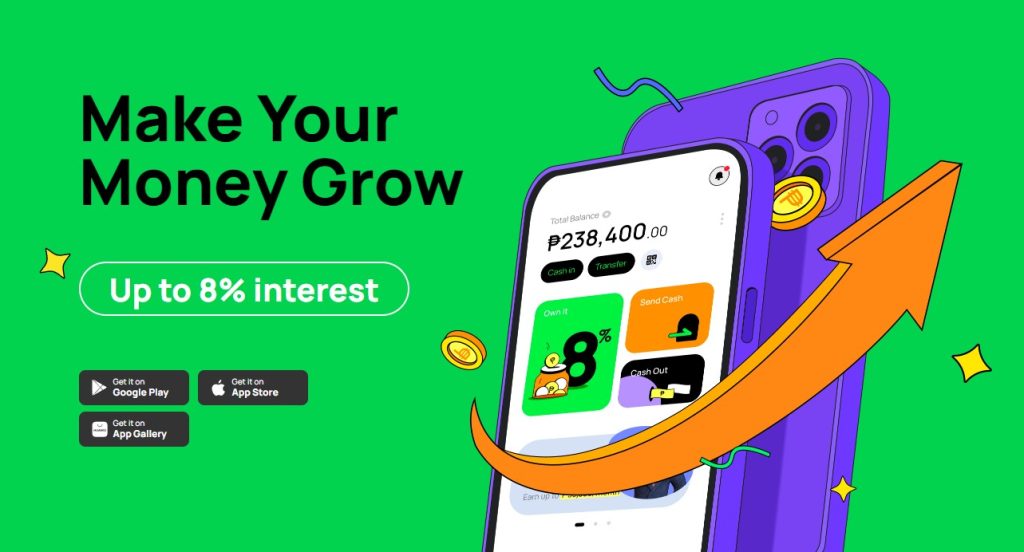

OwnBank is a digital bank in the Philippines that offers users an 8% per annum savings interest rate. Moreover, the bank has been in the industry since 1956, known as The Rural Bank of Cavite City. Moreover, in 2021, they went digital.

Is it Legit?

Of course, it won’t hurt to try to be safe, especially when it’s our life savings on the line. But, yes, OwnBank is legit. It is supported by many major banks and digital wallets in the Philippines. OwnBank is also in collaboration with PESONet and InstaPay.

In addition, OwnBank is equipped with a multi-factor authentication code to keep the users’ accounts safe. There are also AI-driven security technologies and strict compliance guidelines.

Is there a minimum deposit?

Here’s the good news: there is no minimum deposit to create an account. Maintaining a balance or minimum deposit is quite a hassle, especially for those who do not have money for it.

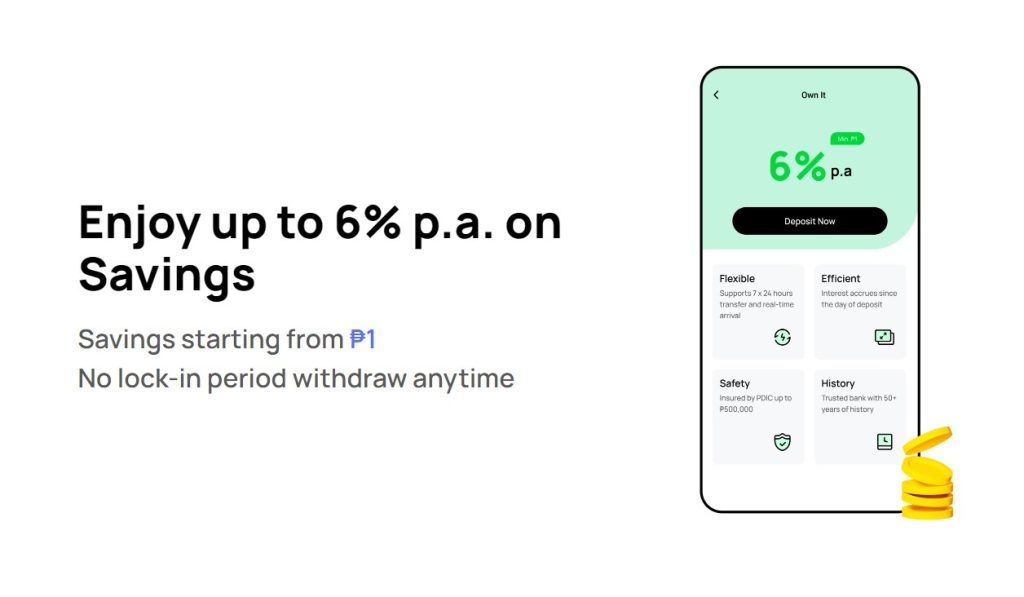

Furthermore, OwnBank has an 8% interest p.a. In 7 days, daily credits are given to users with high-interest savings of up to 6%.

Where to Download?

Are you interested in using OwnBank? You can download the online banking application on both Google Play Store and Apple App Store.