Apple Pay is finally edging closer to the Philippine market, with industry leaders now pointing to a third-quarter 2026 launch. While regulatory approval is already in place, the rollout has taken longer than expected due to behind-the-scenes preparations. Read on to understand why the wait matters and what it means for everyday users.

Why the Timeline Shifted

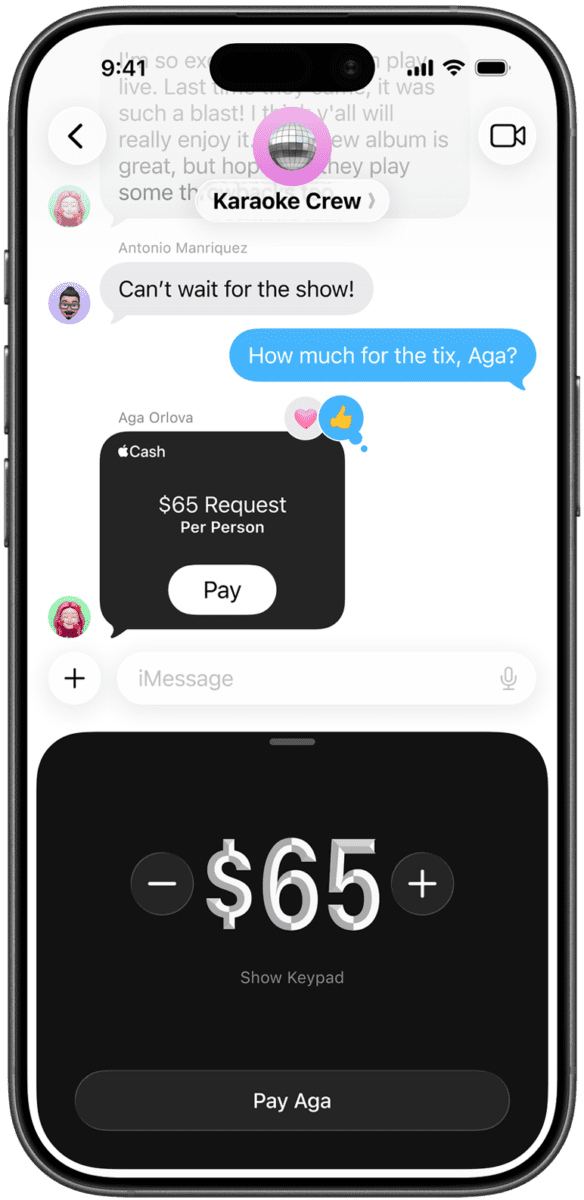

The service was initially eyed for an earlier release, but the schedule was pushed back to allow major banks and payment platforms to align. FinTech Alliance PH chairman Lito Villanueva said Apple wants a strong, synchronized launch rather than a limited rollout. This approach is meant to avoid uneven access and fragmented user experience.

Green Light from Regulators

The Bangko Sentral ng Pilipinas has already cleared Apple Pay to operate in the country. Regulators classify Apple Pay as a technology service provider, meaning it does not directly handle or store consumer funds. This cleared the way for launch once banks and merchants are ready.

Banks Hold the Key

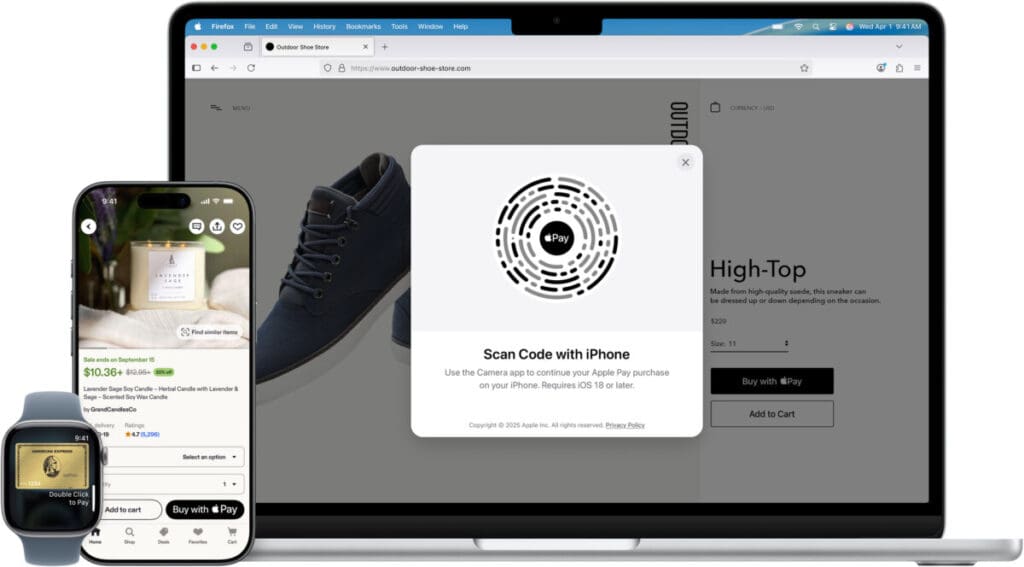

Despite Apple Pay’s readiness, the final switch depends on issuing banks meeting technical and security requirements. Visa Philippines confirmed that Apple works directly with partner banks, making their preparedness a critical factor. Some institutions are still completing system integration and testing.

Lessons from Google Pay

Google Pay’s launch in late 2025 offered a preview of how mobile wallets can gain traction locally. With most Filipinos using Android devices, adoption came quickly, especially among merchants. Apple Pay is expected to follow a similar path once it goes live.

E-Wallets and Market Readiness

Major e-wallet platforms like GCash, Maya, and GoTyme are already prepared for Apple Pay integration. Industry leaders say much of the technical groundwork across the payments sector has been completed. The remaining task is coordinating timing across key players.

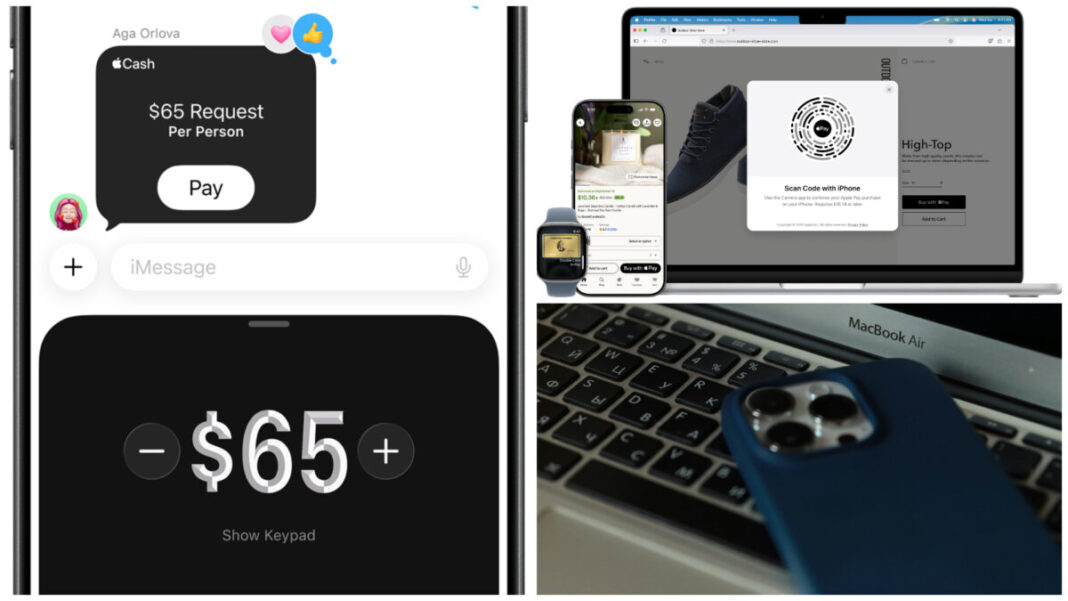

Beyond Retail Payments

Apple Pay’s arrival could extend beyond stores and online shopping. Contactless payments are also being prepared for public transport systems, including rail lines. These developments are seen as crucial to pushing daily cashless use.

A Shift Toward Cash-Lite Living

As more payment options become available, consumer habits are expected to change. Industry groups believe mobile wallets will help reduce friction in everyday transactions. Apple Pay’s entry is shaping up to be another step in the country’s gradual move toward a cash-lite economy.