Travel plans usually begin with airfare and accommodation, but for Filipinos there is another cost: quietly waiting at the airport. A mandatory travel tax, paid separately from plane tickets, has long been part of outbound journeys. While many accept it as routine, renewed public attention is pushing the issue back into national discussion.

A Policy Rooted in History

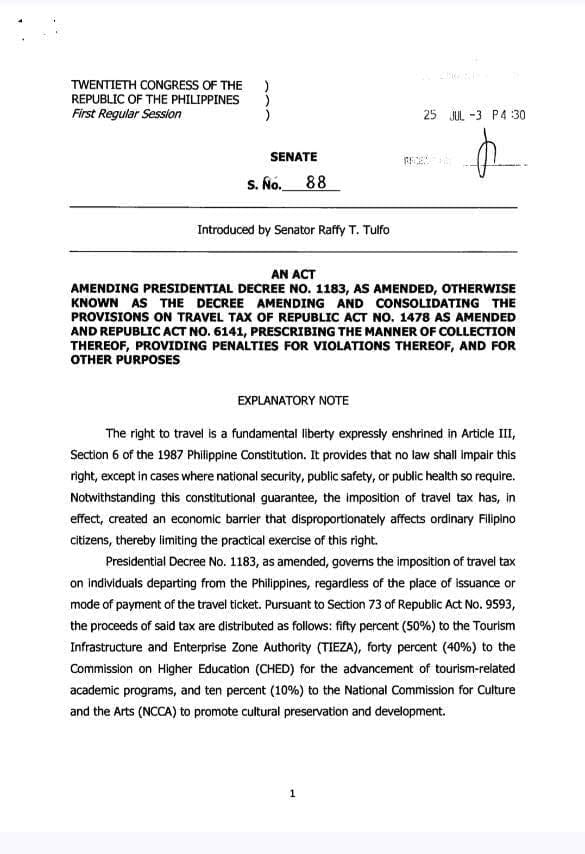

The travel tax did not appear overnight, as its origins go back to Republic Act No. 1678 passed in 1956. Its current structure was reinforced during the Marcos Sr. administration through Presidential Decree No. 1183 in 1977. What started as a tourism funding mechanism has since evolved into a regular requirement for departing travelers.

Who Pays and How Much

The levy applies to Filipino citizens, permanent resident aliens, and foreign passport holders who have stayed in the country for more than one year. Today, economy class passengers pay P1,620, while first-class travelers are charged P2,700. Reduced and privileged rates exist, including special concessions for dependents of overseas Filipino workers.

Collections from the travel tax are divided among three government institutions. Half of the funds go to the Tourism Infrastructure and Enterprise Zone Authority to support tourism facilities and projects. The remaining share is split between the Commission on Higher Education for tourism-related courses and the National Commission for Culture and the Arts for cultural programs.

Standing Alone in Southeast Asia

Among Southeast Asian nations, the Philippines is the only country that still imposes a separate travel tax on its departing citizens. The ASEAN Tourism Agreement signed in 2002 encouraged member states to phase out similar levies to promote regional travel. Despite this commitment, the Philippine policy remains unchanged more than two decades later.

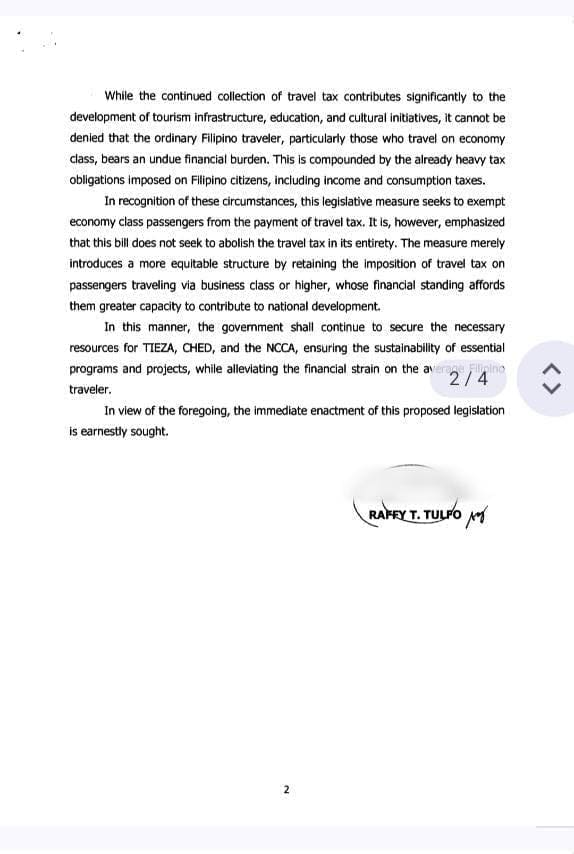

Lawmakers Push for Change

Recent proposals in the Senate have reignited debate over the necessity of the tax. Measures filed by Senators Raffy Tulfo and Erwin Tulfo seek to exempt economy class passengers or abolish the levy entirely. Supporters argue that removing the tax could make travel more accessible and align the country with its regional neighbors.

The travel tax now sits at the crossroads of revenue generation and mobility rights. Critics see it as an added burden on ordinary travelers already facing rising costs. As Congress reviews proposed reforms, the question remains whether the policy still serves its original purpose in today’s travel landscape.