Institutional demand for Bitcoin (BTC) cooled in August, as major firms cautiously scaled back their allocations. While institutions hesitated, retail and early-stage investors have been flocking to Bitcoin Hyper (HYPER), the fastest Layer 2 protocol built on Bitcoin.

The presale has already raised nearly $14.5 million, signaling that while some players pause, others are spotting a rare bullish catalyst with enormous potential for growth. The excitement around Bitcoin Hyper stems from its ability to bring real, utility-driven demand to the Bitcoin ecosystem.

Unlike BTC, which is primarily used as a store of value, Hyper allows developers to launch decentralized applications (dApps) that expand Bitcoin’s functionality beyond what the main chain can handle.

Investors see HYPER as a unique opportunity to capture exponential gains similar to Bitcoin’s early days, but this time backed by an ecosystem designed for active, real-world use.

Currently priced at $0.012875, HYPER’s presale window is closing soon. Once this phase ends, the token will advance to the next stage at a higher price, making now one of the last opportunities to acquire it at a rock-bottom rate.

Early participants can secure their position before major exchange demand drives the price upward, giving them a potential edge in what could become a high-volume market.

With institutional BTC accumulation slowing, CryptoQuant reports that ETFs are seeing withdrawals exceeding $1 billion in some weeks, Bitcoin remains largely a store of value rather than a utility asset.

While companies continue to hold BTC as a hedge against inflation, its practical use remains limited compared to assets like gold, which offer industrial and cultural utility. Bitcoin Hyper addresses this gap, creating a system where each BTC can perform real functions through a scalable, secure Layer 2 ecosystem.

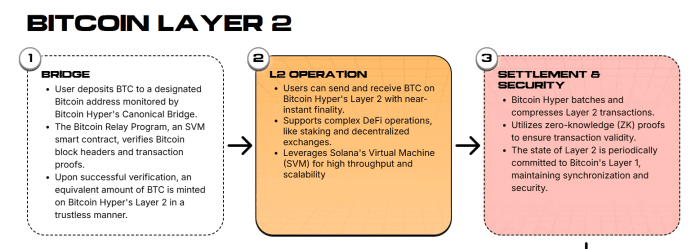

Bitcoin Hyper achieves this by integrating the Solana Virtual Machine (SVM) as its execution layer, enabling fast, low-cost transactions while retaining Bitcoin’s security for settlement.

Developers can migrate Solana-based dApps to Hyper with minimal adjustments, opening the door for proven projects to operate within the Bitcoin ecosystem. Through the Canonical Bridge, BTC locked on the main chain is converted into wrapped BTC for use in Hyper, preserving trust while unleashing new utility.

This design has investors arguing that Bitcoin Hyper combines the best of both worlds, the security of Bitcoin and the speed and versatility of Solana, potentially solving the blockchain trilemma while generating new avenues for token demand.

Bitcoin Stalls as Institutions Hold Back: Hyper Utility Awaits

CryptoQuant’s on-chain data reveals that BTC purchases by institutional treasuries have slowed significantly. Accumulation remains far less aggressive than at the beginning of the year.

For example, Strategy added only 1,200 BTC in August, while other firms acquired an average of 343 BTC each. This weakness is also reflected in ETF flows, which began to decline in late July. Indeed, during the week of August 18, more than $1 billion left Bitcoin ETFs, marking one of the sharpest declines of the year.

This drop in demand is keeping Bitcoin in a tight range. The leading crypto asset is hovering around $111,000, down 0.6% over two weeks and 4.7% over the past 30 days. Companies are adding BTC to their treasuries as a hedge against inflation and as a long-term store of value.

But in this context, Bitcoin lags behind gold, which offers utility beyond its role as an inflation hedge. Moreover, gold has industrial and cultural uses, while Bitcoin remains primarily a tool for storing digital wealth. In other words, we are not carrying digital currency.

For Bitcoin to truly compete with gold, it must move beyond its function as a store of value. This is where Bitcoin Hyper comes in. The project aims to make each BTC much more useful than just a trophy asset in institutional or retail portfolios.

Bitcoin Hyper: Solving the Blockchain Trilemma

Bitcoin Hyper enters the crypto arena by allowing developers to create a wide range of applications that are impossible to achieve on the main chain.

To achieve this, Layer 2 integrates the Solana Virtual Machine (SVM) as the execution layer. All dApps and contracts on Hyper run on the same engine as Solana, ensuring speed and low transaction costs, while leveraging the security of Bitcoin.

Because SVM is SPL-compliant, developers already working on Solana can migrate their applications to Bitcoin Hyper with minimal changes. This allows a large number of proven projects to quickly expand the Bitcoin ecosystem without starting from scratch.

The bridge between these two worlds is the project’s Canonical Bridge. Every BTC locked on the main chain can be transferred to the Hyper ecosystem, where it becomes a wrapped BTC fully usable in the Solana-powered environment. This mechanism unlocks Bitcoin’s utility and redirects activity to a faster execution layer.

However, it all comes back to Layer-1 Bitcoin for security and settlement. When a user wants to retrieve their Bitcoin, they simply burn the wrapped version to unlock the original BTC. In short, this process ensures that, despite Hyper ‘s scalability and speed , Bitcoin’s trust layer remains intact.

This combination has some investors arguing that Bitcoin Hyper brings together the best of both crypto worlds. This is why it could represent the most robust answer to Vitalik Buterin ‘s blockchain trilemma.

HYPER’s Launchpad: From Solana Speed to Bitcoin Security

As mentioned, migrating a Solana-based application to the Bitcoin Hyper ecosystem remains relatively straightforward. Developers run their projects at Solana’s speed while securing them on the most decentralized and censorship-resistant blockchain available.

Moreover, this design doesn’t just benefit Bitcoin. It also generates direct demand for HYPER, the token that powers gas fees, staking, and governance. While BTC serves as the medium of exchange in the Hyper ecosystem, it is HYPER that powers the system.

This is why many investors consider HYPER as their second chance after missing out on BTC’s first surge. If Bitcoin Hyper becomes the center of dApps, then HYPER positions itself at the heart of a new demand channel for BTC utility. For example, DeFi on Solana alone holds $11.2 billion in total value locked.

If even a quarter of this activity migrates to Bitcoin Hyper, it could trigger a massive volume of BTC transactions not just related to price speculation. And that’s just one sector. So by adding gaming, NFTs, and tokenized real assets, the scale of the opportunity becomes even more impressive.

This is why popular crypto influencers, including Crypto Tech Gaming, have highlighted Bitcoin Hyper’s potential to generate 100x returns.

Race to $15 Million: Secure Your HYPER Tokens Before the Surge

Bitcoin Hyper’s presale is moving at lightning speed, with an average of $150,000 raised daily. At this pace, the next major milestone of $15 million could be reached in less than two days, making it one of the most critical windows for investors to get in early.

With altcoins dominating the spotlight this month, HYPER presents a rare opportunity to secure tokens at one of the lowest presale prices before the next phase pushes the value higher. Participating is straightforward and accessible.

Investors can purchase HYPER using popular cryptocurrencies such as SOL, ETH, USDT, USDC, or BNB or even via a credit card for maximum convenience. Newly acquired tokens aren’t just sitting idle: they can be staked through Bitcoin Hyper’s protocol, offering a dynamic and explosive yield of 76% APY.

This allows early adopters to start earning while contributing to the ecosystem’s growth. For a seamless experience, Best Wallet provides direct access to the presale. HYPER is listed under the “Upcoming Tokens” section, making it simple to buy, track, and claim once the token becomes active.

Investors can also stay up to date with the latest news, community updates, and real-time discussions on Telegram and X. With momentum building quickly, now is the moment to be part of Bitcoin Hyper’s historic growth and secure your stake before the surge.