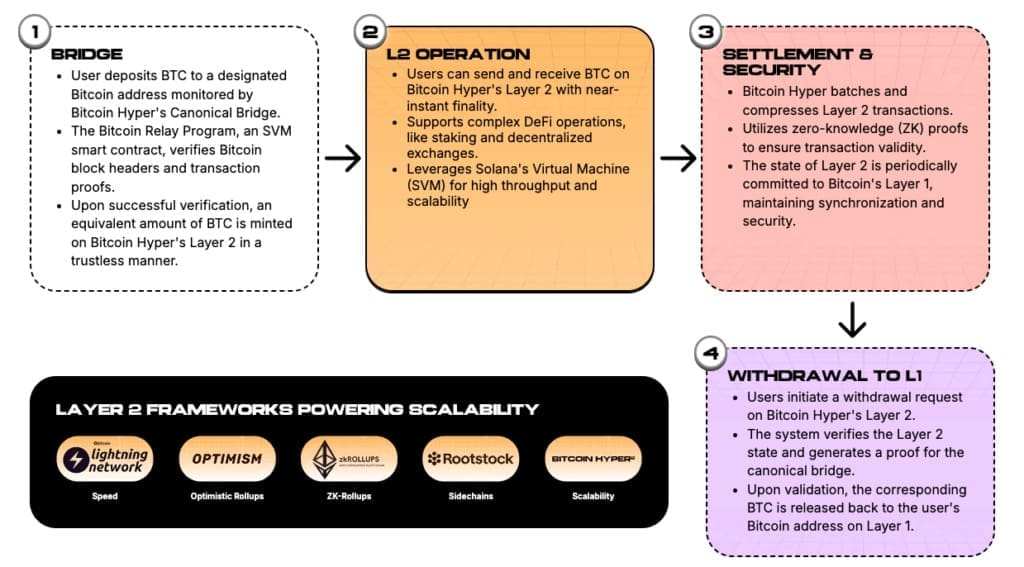

By using the Solana Virtual Machine (SVM) as its execution layer, Bitcoin Hyper preserves the security and decentralization of the Bitcoin mainnet while enabling fast transactions and minimal fees.

Hyper converts Bitcoin from a passive investment into an actively utilized digital asset by establishing a connection between these two separate blockchain ecosystems. Developers can implement complex dApps that are based on Bitcoin’s reliable Proof-of-Work network, such as financial protocols, gambling platforms, and NFT platforms.

The ecosystem’s lifeblood is the HYPER token, which powers transaction fees, staking incentives, governance involvement, and ecosystem growth. Due to its bidirectional nature, users can mint wrapped copies of Bitcoin on Layer 2 and lock it on Layer 1, allowing them to redeem native Bitcoin at any time.

This allows for a new degree of utility and interactivity while simultaneously giving Bitcoin owners total control over their assets. Bitcoin Hyper’s anticipated potential is reflected in the market’s attention. By 2030, the HYPER token is anticipated to be worth $1.90, more than 10 times its current value, and $0.21 at the end of 2025.

This initiative has the potential to significantly alter Bitcoin’s position in the cryptocurrency industry, particularly if Layer-2 adoption obtains traction. While Ethereum and Bitcoin Hyper take divergent paths, their stories intersect to shape the future of cryptocurrency.

Ethereum’s smart contract ecosystem continues to attract developers and institutional investors, while Bitcoin Hyper presents a new paradigm that will allow Bitcoin to transition from a static store of value to a scalable platform. Collectively, these attempts indicate how the next generation of digital assets will value both creative technologies and valuable applications.

For long-term investors, Ethereum and Bitcoin Hyper provide complimentary promise. Ethereum is still a vital resource for developing and interacting with decentralized systems, even though Bitcoin Hyper is the start of a new BTC story that has the ability to unlock latent utility and drive the next big wave of adoption.

Strategic capital allocation can be guided by monitoring the growth of both platforms, ensuring exposure to activities that will influence the cryptocurrency’s future.

Realistic Challenges in Making Predictions

Although it’s a great notion, analysts and investors don’t believe that Ethereum could expand 35 times. Ethereum’s market capitalization would need to exceed $20 trillion, or more than half of the S&P 500’s current value, in order to hit this milestone.

Such growth requires broad user adoption, more transparent regulatory frameworks, and a solid financial base that can sustain institutional involvement in addition to continuous technological advancement. Even the most compelling projections could be hampered or delayed in the absence of these crucial components.

The Proof-of-Stake (PoS) switch for Ethereum was successful, but there are still issues with the network. Scalability and gas cost control are still key challenges as demand rises and decentralized apps develop.

Ethereum’s attractiveness for mass adoption may be hindered by network congestion or high transaction costs, hence developers and investors must keep a check on these concerns. To continue growing and meeting high price expectations, Ethereum needs to overcome these technological obstacles.

Mistrust is further reinforced by the market’s overall performance. Over the previous five years, Ark Invest’s flagship ETF, which has been closely linked to Cathie Wood’s bullish outlook, has underperformed the S&P 500. Some market investors wonder if the unduly aggressive 35x growth forecast can be met in light of this historical underperformance.

The problems are not just theoretical; they highlight how important it is to balance optimistic projections with realistic evaluations of the market, competition, and investor behavior. Ethereum is still a vital component of the cryptocurrency ecosystem even if it fails to reach the 35x target.

Its dominance of the decentralized app and smart contract markets offers a strong basis for long-term investment strategies and capital allocation. Ethereum is a clear choice for risk hedging and strategic exposure because of its extensive use, continuous network improvements, and active development.

A New Force in the Bitcoin Race: Bitcoin Hyper Takes Center Stage

While the market focus is on the future potential of Ethereum (ETH), another technical narrative related to Bitcoin is also taking shape. Bitcoin Hyper (HYPER), one of the most anticipated Bitcoin Layer 2 projects, has officially ignited market discussion with its pre-sale of nearly $14.5 million.

The project, utilizing the Solana Virtual Machine (SVM) as its execution layer, aims to transform Bitcoin from a simple store of value into a programmable smart asset capable of use in DeFi and gaming.

Bitcoin Hyper ‘s design logic is to combine two extreme attributes: Bitcoin’s ultimate security and Solana’s high-speed performance. Theoretically, this allows it to balance efficiency and decentralization by supporting complicated contract execution, cheap fees, and instant transactions.

This approach may create a new Bitcoin ecosystem and expand the capabilities of Bitcoin by enabling application scenarios like as DeFi, NFTs, and on-chain gaming.

The HYPER token is predicted to be worth $0.21 by the end of 2025, but it might increase to $1.90 by 2030, which is by far more than 10 times its current value. For investors looking to profit from the next Bitcoin story, this potential offers an alluring early entry opportunity.

Different Roles, Jointly Depicting the Future of Encryption

Despite having different technical paths, Ethereum and Bitcoin Hyper have a goal, solidifying the foundation for the impending cryptocurrency era. Due to its strong developer environment and smart contract features, Ethereum has become the go-to platform for innovation in DeFi, NFTs, Web3 applications, and enterprise blockchain solutions.

Ethereum contributes significantly to the broader crypto economy by providing developers and investors with a platform that consistently fosters acceptance and usefulness. On the other hand, the goal of Bitcoin Hyper is to unleash the hidden potential of Bitcoin.

Historically viewed as a static store of value, BTC has lacked the flexibility required for complex applications. By fusing Layer-2 technology with the Solana Virtual Machine, Bitcoin Hyper closes this gap and turns Bitcoin into a programmable financial infrastructure that can manage DeFi protocols, NFT platforms, gaming apps, and instant transactions.

This innovation makes Bitcoin a dynamic and usable asset that radically changes how developers and investors engage with it. ETH will hold a crucial place at the nexus of established banking and cutting-edge technologies if Cathie Wood’s forecast of a 35x Ethereum boom materializes.

It will impact institutional adoption, regulatory frameworks, and cross-industry integration in addition to serving as a fundamental asset for digital finance. At the same time, Bitcoin Hyper’s successful implementation of a Layer-2 ecosystem would change the story of Bitcoin and dispel the long-held belief that it can only be used as a store of value.

In their different capacities, both initiatives are changing the perception of what cryptocurrency is capable of. These discoveries have wider ramifications than just how well individual tokens function. Together, Ethereum and Bitcoin Hyper impact market sentiment, establish technological standards, and affect capital flows.

They lay the stage for a time when cryptocurrencies will be essential parts of the global financial system in addition to being investment vehicles by extending the functional limitations of two of the most well-known digital assets. When taken as a whole, these stories paint a picture of a more technologically sophisticated, connected, and adaptable crypto ecosystem.

Ethereum and Bitcoin Hyper Provide Directions for Different Fund Allocations

Long-term investors are becoming more interested in initiatives that blend innovation with core value, despite the fact that the bitcoin market has not yet fully recovered from recent turmoil. In this sense, Ethereum remains unique. It is the top platform for smart contracts and decentralized apps, offering the backbone of an extensive and expanding ecosystem that includes Web3 services, NFT marketplaces, and DeFi protocols.

Ethereum is a strategic investment for fund managers and institutional investors in an asset that is not only extensively used but also essential to the larger development of blockchain technology. Its energy-efficient PoS network and scalability enhancements make it an even more alluring long-term investment.

Bitcoin Hyper, in contrast, introduces a different kind of opportunity. It aims to turn Bitcoin into a programmable asset rather than expanding upon a general-purpose smart contract platform.

Bitcoin Hyper preserves the security and immutability of the Bitcoin mainnet while enabling BTC to engage in high-speed transactions, DeFi apps, gaming, and NFTs by fusing Layer-2 capabilities with the Solana Virtual Machine.

Hyper offers a means for investors who want to get involved with Bitcoin outside of the conventional “store of value” story to profit from utility-driven demand growth and the possible development of a new BTC-based ecosystem.

Bitcoin Hyper and Ethereum together show how diverse fund allocations might capture various aspects of cryptocurrency growth. Ethereum offers exposure to established smart contract adoption, network effects, and institutional credibility, making it a solid alternative for long-term strategic investments.

Bitcoin Hyper, on the other hand, is a riskier but possibly more profitable approach that takes advantage of the development and expansion of Bitcoin usage. Investors should balance these two narratives at the same time and allocate capital to both well-established infrastructure projects and state-of-the-art Layer-2 technologies in order to position their portfolios to benefit from the impending major adoption cycles.