Prices have indeed got higher these past few months, affecting many Filipinos with tighter budgets and shallower pockets. Aside from that, there’s also the news about the pending increase for the SSS and PhilHealth contributions, adding more expenses for some low-earning Filipinos.

But behind all of those is good news for the taxpaying citizens. Individuals with Purely Compensation Income, including Single Proprietors and those with Non-Business/Non-Profession Related Income, can anticipate increased take-home pay in 2023.

This tax update is per Tax Reform for Acceleration and Inclusion (TRAIN) Law, also known as Republic Act (R.A.) No. 10963, which went into effect on January 1st, 2018.

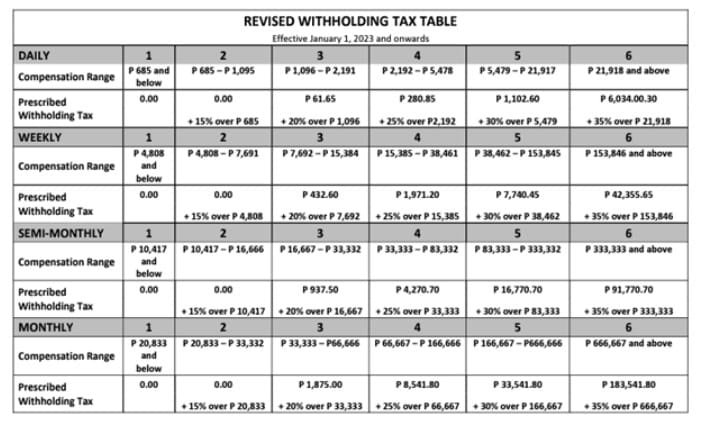

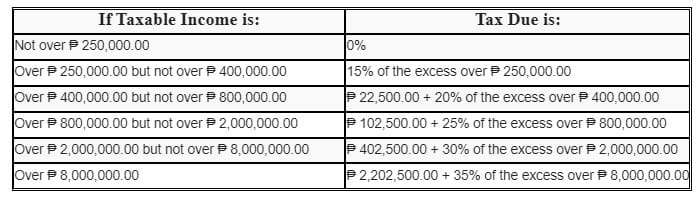

Beginning January 1, 2023, under the TRAIN Law, individual taxpayers who make less than P250,000 a year are still not subject to income tax. 15% to 30% will now apply to anyone making between P250,000 and P8,000,000 (down from 20% to 32% before 2023).

Individuals with taxable income above P8,000,000.00, however, will continue to pay tax at the same rate of 35%.

From January 1, 2023, onward, the income tax on the person’s taxable income will be calculated using the following schedules:

The new annual income tax rates significantly decreased by 5% for those with taxable income of more than $250,000 up to $2,000,00, while a 2% decrease for those with taxable income of more than $2,000,00 up to $8,000,000. This compares to the income tax rates imposed during the initial implementation of the TRAIN Law in 2018.

This holds promise for many Filipinos, especially the taxpayers. Truly, there are things worth looking forward to this 2023.